UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx ☒

Filed by a Party other than the Registrant¨ ☐

Check the appropriate box:

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under § 240.14a-12 |

Community Bankers Trust Corporation

(Name of Registrant as Specified In Its Charter)

(Name (Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

[LOGO – COMMUNITY BANKERS TRUST CORPORATION]CORPORATION LOGO]

Dear Shareholder:

You are cordially invited to attend the 20182021 Annual Meeting of Shareholders of Community Bankers Trust Corporation, to be heldthe holding company for Essex Bank, on Friday, May 18, 2018,21, 2021, at 11:10:00 a.m. Eastern Time. Due to the public health concerns of the coronavirus pandemic, and in the interest of providing the safest environment possible, we will be holding this year’s Annual Meeting of Shareholders in a virtual format only, online through the internet. You will be able to attend the Annual Meeting, vote your shares and submit your questions by visiting https://www.cstproxy.com/cbtrustcorp/2021 and entering the 12-digit control number included on your proxy card. Information for the virtual meeting will also be available at the Deep Run 3 Building, 9954 Mayland Drive, Richmond, Virginia 23233.http://www.cbtrustcorp.com.

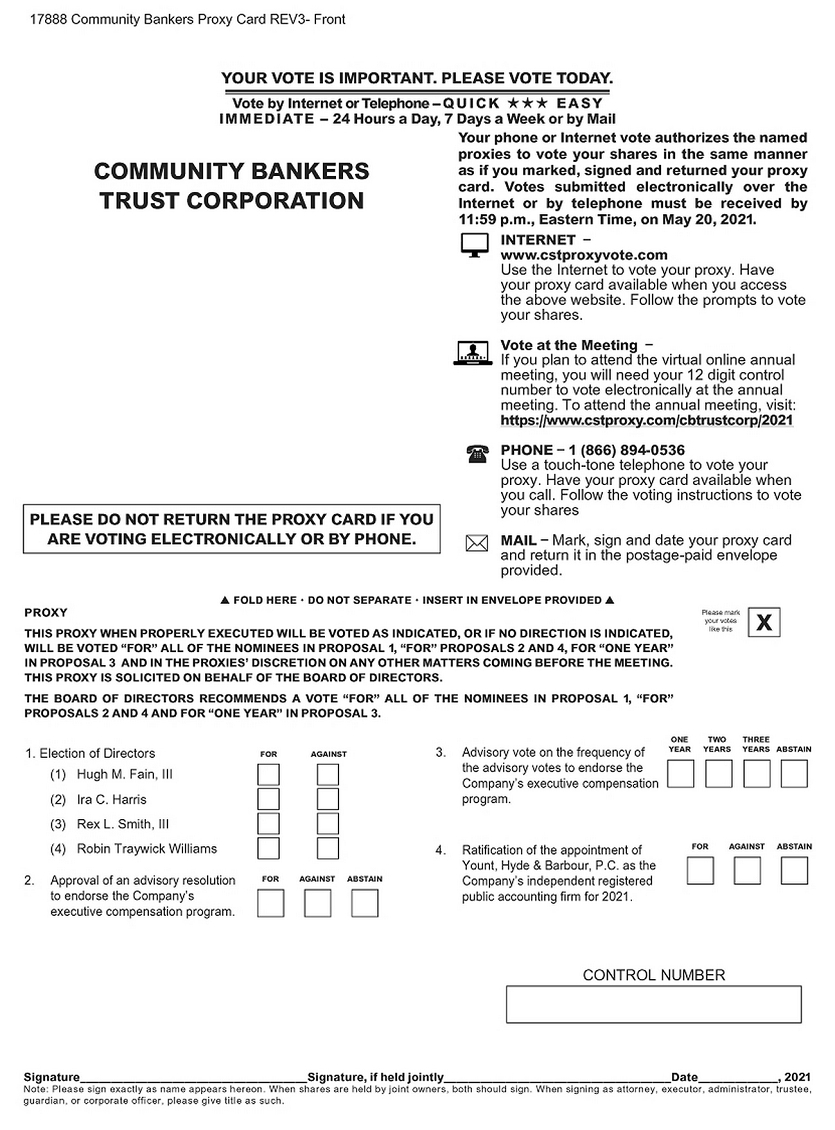

At the Annual Meeting, you will be asked to elect three directors for a term of three years and one director for a term of two years. You will also be asked to approve an advisory resolution to endorse the Company’s executive compensation program, to hold an advisory vote on the frequency of the advisory votes to endorse the Company’s executive compensation program and to ratify the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for 2018. Enclosed with this letter are a2021. A formal notice of the Annual Meeting aand the Company’s proxy statement and a form of proxy.follow this letter.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted. Please complete, sign, date and return the enclosed proxy promptly using the enclosed postage-paid envelope. The enclosed proxy, when returned properly executed, will be voted in the manner directed in the proxy. You can also vote your shares by voting through the Internetinternet or by telephone by following the instructions on your proxy card.

We hope that you will participate in the Annual Meeting, either in persononline or by proxy.

| Sincerely, | |

| /s/ Rex L. Smith, III | |

| Rex L. Smith, III | |

| President and Chief Executive Officer |

Richmond, Virginia

April 13, 201819, 2021

COMMUNITY BANKERS TRUST CORPORATION

9954 Mayland Drive, Suite 2100

Richmond, Virginia 23233

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders of Community Bankers Trust Corporation will be held on Friday, May 18, 2018,21, 2021, at 11:10:00 a.m. local time, atEastern Time. The Annual Meeting will be held in a virtual format only, online through the Deep Run 3 Building, 9954 Mayland Drive, Richmond, Virginia 23233,internet. You will be able to attend the Annual Meeting, vote your shares and submit your questions by visiting https://www.cstproxy.com/cbtrustcorp/2021 and entering the 12-digit control number included on your proxy card.

The Annual Meeting will be held for the following purposes:

| (1) | The election of three directors to a three-year term on the Board of Directors and one director for a two-year term on the Board of Directors; |

| (2) | The approval of the following advisory (non-binding) resolution: |

RESOLVED, that the shareholders approve the compensation of executive officers as disclosed in the proxy statement for the 20182021 Annual Meeting of Community Bankers Trust Corporation pursuant to the rules of the Securities and Exchange Commission.

| (3) | The holding of an advisory (non-binding) vote on the frequency of the advisory votes to endorse the Company’s executive compensation program; |

| (4) | The ratification of the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for |

| The transaction of any other business that may properly come before the meeting and any adjournments or postponements of the meeting. |

If you were a shareholder of record at the close of business on March 21, 2018,April 13, 2021, then you are entitled to vote at the Company’s Annual Meeting and any adjournments or postponements of the meeting. You are also cordially invited to attend the meeting.

Your vote is important. Whether or not you plan to attend the meeting, please vote as soon as possible. You can vote your shares by completing and returning your proxy card or by voting through the Internetinternet or by telephone by following the instructions on your proxy card. For additional details, please see the information under the heading “How do I vote?”.

| By Order of the Board of Directors, | |

| /s/ John M. Oakey, III | |

| John M. Oakey, III | |

| Secretary |

April 13, 201819, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 18, 2018:21, 2021:

The proxy statement is available on the Company’s investor web site

website atwww.cbtrustcorp.com.www.cbtrustcorp.com.

TABLE OF CONTENTS

| Report of the Audit Committee | 44 |

| Shareholder Proposals | 45 |

| Annual Reports | 46 |

PROXY STATEMENT

This proxy statement is being furnished to the holders of common stock, par value $0.01 per share, of Community Bankers Trust Corporation, a Virginia corporation. Proxies are being solicited on behalf of the Board of Directors of the Company to be used at the 20182021 Annual Meeting of Shareholders. The Annual Meeting will be held at the Deep Run 3 Building, 9954 Mayland Drive, Richmond, Virginia 23233, on Friday, May 18, 2018,21, 2021, beginning at 11:10:00 a.m. local time,Eastern Time, for the purposes set forth in the Notice of Annual Meeting of Shareholders.

The Annual Meeting will be held in a virtual format only, online through the internet. You will be able to attend the Annual Meeting, vote your shares and submit your questions by visiting https://www.cstproxy.com/cbtrustcorp/2021 and entering the 12-digit control number included on your proxy card. If you would like to attend the Annual Meeting as a guest, you should contact the Company in advance at shareholder@essexbank.com, but, as a guest, you will not be able to vote your shares during the meeting or submit questions. You can also listen to the Annual Meeting by telephone by calling 877-770-3647 and entering passcode 22017550#, but you will not be able to vote your shares during the meeting or submit questions.

Information for the virtual meeting will also be available at http://www.cbtrustcorp.com.

Your vote is important. Whether or not you plan to attend the meeting, please vote as soon as possible.

THE ANNUAL MEETING AND VOTING

Why did I receive these proxy materials?

This proxy statement will be mailed to holders of the Company’s common stock on or about April 18, 2018.23, 2021. The Company’s Board of Directors is asking for your proxy. By giving the Company your proxy, you authorize the proxy holders (Rex L. Smith, III, Bruce E. Thomas and John M. Oakey, III) to vote your shares at the Annual Meeting according to the instructions that you provide. If the Annual Meeting adjourns or is postponed, your proxy will be used to vote your shares when the meeting reconvenes.

The Company’s 20172020 Annual Report to Shareholders, which includes a copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2017,2020, as filed with the Securities and Exchange Commission, is being mailed to shareholders with this proxy statement.

May I attend the Annual Meeting?

All shareholders are invited to attend the meeting.Annual Meeting. It will be held on Friday, May 18, 2018, beginning21, 2021, at 11:10:00 a.m. local time, atEastern Time and in a virtual format only, online through the Deep Run 3 Building, 9954 Mayland Drive, Richmond, Virginia 23233.internet.

Even if you plan to attend the Annual Meeting, please vote your proxy in advance through the Internet,internet, by telephone or by mail.

Who is entitled to vote?

If you are a shareholder of the Company’s common stock at the close of business on the Record Date of March 21, 2018,April 13, 2021, you can vote. There were 22,084,19322,219,926 shares of common stock outstanding and entitled to vote on that date. For each matter properly brought before the Annual Meeting, you have one vote for each share that you own.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered directly in your name with the Company’s transfer agent, Continental Stock Transfer & Trust Company, you are considered, with respect to those shares, the “shareholder of record.” The Notice of Annual Meeting of Shareholders, this proxy statement and the 20172020 Annual Report to Shareholders have been sent directly to you by the Company.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name.” The Notice of Annual Meeting of Shareholders, this proxy statement and the 20172020 Annual Report to Shareholders have been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the “shareholder of record.” As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote your shares using the voting instruction card included in the mailing or by following the instructions on that card for voting by telephone or through the Internet.internet.

How do I vote?

You may vote using any of the following methods:

| · | Telephone –You can vote by calling the toll-free telephone number on your proxy card. Please have your proxy card in hand when you call. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. |

| · | Internet –You can vote by visiting the |

| · | Mail –You can vote by signing and dating the proxy card and returning it in the enclosed postage-paid envelope. |

| · |

A valid proxy, if not revoked or voted otherwise, will be votedFOR the election of the nominees for director named in this proxy statement,FOR the approval of a non-binding resolution to endorse the Company’s executive compensation program, FOR the approval of a frequency of “every year” for the advisory votes to endorse the Company’s executive compensation program andFOR the ratification of the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for 2018.2021.

If your shares are held in “street name,” do not follow the above instructions. Instead, follow the separate instructions provided by your broker, bank or other nominee.

2

Can I change my vote?

If you are a shareholder of record, you may revoke your proxy or change your vote at any time before it is voted at the Annual Meeting by

| · | submitting a new proxy by telephone or through the | |

| · | returning a signed proxy card dated later than your last proxy; | |

| · | submitting a written revocation to the Secretary of Community Bankers Trust Corporation at 9954 Mayland Drive, Suite 2100, Richmond, Virginia 23233; or |

| · |

If your shares are held in “street name” by your bank, broker or other nominee, you may revoke your proxy or change your vote only by following the separate instructions provided by your bank, broker or nominee.

To vote in person at the Annual Meeting, you must attend the meeting and cast your vote in accordance with the voting provisions established for the Annual Meeting. Attendance at the Annual Meeting without voting in accordance with the voting procedures will not in and of itself revoke a proxy.

If you are a beneficial owner of shares held in street name and hold your shares through a broker, bank broker or other nominee, holds your shares and you wantmust register in advance to attend and vote your shares atduring the Annual Meeting,Meeting. To register, you must bringfirst obtain a legal proxy signedfrom your broker, bank or other nominee and email proof of your legal proxy, either as a forwarded email from your broker, bank or other nominee or as an attached image of your legal proxy, reflecting the number of shares of the Company’s common stock that you held as of the record date, along with your name and email address to the Company’s transfer agent, Continental Stock Transfer & Trust Company, at proxy@continentalstock.com. Requests for registration must include the subject line “Legal Proxy” and be received by the transfer agent no later than 5:00 p.m., Eastern Time, on Monday, May 17, 2021. You will receive a confirmation email from the transfer agent of your bank, broker or nomineeregistration and a control number that you can use to vote during the Annual Meeting.

What is a “quorum”?

A quorum consists of a majority of the outstanding shares of the Company’s common stock, as of the Record Date, present, or represented by proxy, at the meeting. A quorum is necessary to conduct business at the Annual Meeting. Inspectors of election will determine the presence of a quorum at the Annual Meeting. You are part of the quorum if you have voted by proxy. Shares for which the holder has abstained, or withheld the proxies’ authority to vote, on a matter count as shares present at the meeting for purposes of determining a quorum. Shares held by brokers that are not voted on any matter at the Annual Meeting will not be included in determining whether a quorum is present at the meeting.

How are votes counted?

The election of each nominee for director requires the affirmative vote of the holders of a pluralitymajority of the shares of common stock voted inpresent or represented by proxy at the election of directors. Thus, those nominees receiving the greatest number of votes cast will be elected.Annual Meeting. You may vote “for” or “withhold” for the election of directors. Shares held by brokers that are not voted in the election of directors will have no effect on the election of directors.

The advisory (non-binding) resolution to endorse the Company’s executive compensation program will be approved if holders of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting vote in favor of the action.

With respect to the advisory (non-binding) vote on the frequency of the advisory votes to endorse the Company’s executive compensation program, the alternative receiving the greatest number of votes – every year, every two years or every three years – will be the frequency that shareholders approve.

The ratification of the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm will be approved if holders of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting vote in favor of the action.

Abstentions and broker non-votes will not be considered cast either for or against a matter. A broker non-vote occurs when a broker or other nominee who holds shares for another does not vote on a particular item because the nominee does not have discretionary voting authority for that item and has not received instructions from the owner of the shares.

Will my shares be voted if I do not provide instructions to my broker?

If you are the beneficial owner of shares held in “street name” by a broker, the broker,bank or other nominee, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not give instructions, to the broker, the brokerbank or other nominee will be entitled to vote the shares with respect to “discretionary” items, but will not be permitted to vote the shares with respect to “non-discretionary” items (those shares are treated as “broker non-votes”).

The election of directors, and the approval of an advisory resolution to endorse the Company’s executive compensation program and the advisory vote on the frequency of the advisory votes to endorse the Company’s executive compensation program are “non-discretionary” items. The ratification of the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for 20182021 is a “discretionary” item.

Your vote is important. Whether or not you plan to attend the meeting, please vote as soon as possible.

Who will count the vote?

The Company has engaged Continental Stock Transfer & Trust Company to serve as the inspector of elections for the Annual Meeting.

What does it mean if I get more than one proxy or voting instruction card?

If your shares are registered in more than one name or in more than one account, you will receive more than one card. Please complete and return all of the proxy or voting instruction cards that you receive (or vote by telephone or through the Internetinternet all of the shares on all of the proxy or voting instruction cards received) to ensure that all of your shares are voted.

The Company is soliciting the proxies associated with this proxy statement and will bear all costs of the solicitation. The Company may solicit proxies by mail, telephone, email, Internet,internet, facsimile, press releases and in person. Solicitations may be made by directors, officers and employees of the Company, none of whom will receive additional compensation for such solicitations. The Company will request banks, brokerage houses and other custodians, nominees and fiduciaries to forward all of its solicitation materials to the beneficial owners of the shares that they hold of record. The Company will reimburse these record holders for customary clerical and mailing expenses incurred by them in forwarding these materials to customers.

The Company has engaged Morrow Sodali LLC to assist in the solicitation of proxies for the Annual Meeting for a fee of approximately $12,500 plus expenses.

BENEFICIAL OWNERSHIP OF SECURITIES

Directors and Executive Officers

The following table sets forth information regarding beneficial ownership of the Company’s common stock, as of March 21, 2018April 13, 2021 (which is the Record Date for the Annual Meeting), for each director, each of the individuals named in the Summary Compensation Table in the “Executive Compensation” section on page 2832 below (who are referred to as the “named executive officers”) and the Company’s current directors and executive officers as a group.

| Name | Shares of Common Stock (2) | Option Shares (3) | Total Shares of Common Stock Beneficially Owned | Percent of Class | Shares of Common Stock (3) | Option Shares (4) | Total Shares of Common Stock Beneficially Owned | Percent of Class | ||||||||||||||||||||||||

| NAMED EXECUTIVE OFFICERS | ||||||||||||||||||||||||||||||||

| Rex L. Smith, III (1) | 50,250 | 165,000 | 215,250 | * | 127,412 | 255,000 | 382,412 | * | ||||||||||||||||||||||||

| Bruce E. Thomas | 29,696 | 18,750 | 48,446 | * | 31,173 | 81,250 | 112,423 | * | ||||||||||||||||||||||||

| Jeff R. Cantrell | 15,150 | 60,000 | 75,150 | * | 30,875 | 72,500 | 103,375 | * | ||||||||||||||||||||||||

| Patricia M. Davis | 1,200 | 60,000 | 61,200 | * | 1,200 | 122,500 | 123,700 | * | ||||||||||||||||||||||||

| John M. Oakey, III | 18,000 | 105,000 | 123,000 | * | 25,475 | 141,250 | 166,725 | * | ||||||||||||||||||||||||

| DIRECTORS | ||||||||||||||||||||||||||||||||

| Gerald F. Barber | 22,436 | — | 22,436 | * | 35,842 | -- | 35,842 | * | ||||||||||||||||||||||||

| Richard F. Bozard | 152,653 | — | 152,653 | * | ||||||||||||||||||||||||||||

| Hugh M. Fain, III | 15,230 | -- | 15,230 | * | ||||||||||||||||||||||||||||

| William E. Hardy | 17,293 | — | 17,293 | * | 44,068 | -- | 44,068 | * | ||||||||||||||||||||||||

| P. Emerson Hughes, Jr. | 100,749 | — | 100,749 | * | ||||||||||||||||||||||||||||

| Troy A. Peery, Jr. | 74,245 | — | 74,245 | * | ||||||||||||||||||||||||||||

| Ira C. Harris | 2,933 | -- | 2,933 | * | ||||||||||||||||||||||||||||

| Gail L. Letts | 6,288 | -- | 6,288 | * | ||||||||||||||||||||||||||||

| Eugene S. Putnam, Jr. | 97,205 | — | 97,205 | * | 114,029 | -- | 114,029 | * | ||||||||||||||||||||||||

| S. Waite Rawls III | 39,281 | — | 39,281 | * | 57,070 | -- | 57,070 | * | ||||||||||||||||||||||||

| John C. Watkins | 108,117 | — | 108,117 | * | 128,138 | -- | 128,138 | * | ||||||||||||||||||||||||

| Oliver L. Way | 31,976 | -- | 31,976 | * | ||||||||||||||||||||||||||||

| Robin Traywick Williams | 65,842 | — | 65,442 | * | 87,665 | -- | 87,665 | * | ||||||||||||||||||||||||

| All current directors and executive officers as a group (15 persons) | 807,844 | 505,750 | 1,313,594 | 5.8 | ||||||||||||||||||||||||||||

| All current directors and executive officers as a group (17 persons) | 753,901 | 702,500 | 1,456,401 | 6.3 | ||||||||||||||||||||||||||||

| * | Less than one percent of class, based on the total number of shares of common stock outstanding on |

| (1) | Mr. Smith is also a director. |

| (2) | Ms. Davis resigned from the Company effective February 28, 2021. The options that Ms. Davis can exercise after her resignation expire on May 29, 2021. |

| (3) | Amounts reflect whole numbers of shares only. Certain directors and executive officers own a fractional share of common stock as a result of automatic dividend reinvestments. Amounts also include the following shares of common stock that the individual owns directly or indirectly through affiliated corporations, close relatives and dependent children or as custodians or trustees: Barber, |

| Amounts reflect shares of common stock that could be acquired through the exercise of stock options within 60 days after |

Principal Shareholders

The following table contains information regarding the persons or groups that the Company knows to beneficially own more than five percent of the Company’s common stock as of March 21, 2018.April 13, 2021.

| Shares of Common Stock Beneficially Owned | ||||||||

| Name and Address | Number | Percent of Class | ||||||

| Wellington Management Group LLP (1) | 1,688,170 | 7.6 | ||||||

| Wellington Group Holdings LLP | ||||||||

| Wellington Investment Advisors Holdings LLP | ||||||||

| Wellington Management Company LLP | ||||||||

| 280 Congress Street | ||||||||

| Boston, Massachusetts 02210 | ||||||||

| EJF Capital LLC (2) | 1,500,000 | 6.8 | ||||||

| Emanuel J. Friedman | ||||||||

| EJF Financial Services Fund, LP | ||||||||

| EJF Financial Services GP, LLC | ||||||||

| 2107 Wilson Boulevard, Suite 410 | ||||||||

| Arlington, Virginia 22201 | ||||||||

| Castine Capital Management, LLC (3) | 1,449,097 | 6.6 | ||||||

| Paul Magidson | ||||||||

| One Financial Center, 24th Floor | ||||||||

| Boston, Massachusetts 02111 | ||||||||

| Banc Fund VII, L.P. (4) | 1,105,642 | 5.0 | ||||||

| Banc Fund VIII, L.P. | ||||||||

| Banc Fund IX, L.P. | ||||||||

| 20 North Wacker Drive, Suite 3300 | ||||||||

| Chicago, Illinois 60606 | ||||||||

| Shares of Common Stock Beneficially Owned | ||||||||

| Name and Address | Number | Percent of Class | ||||||

Fourthstone LLC (1) Fourthstone Master Opportunity Fund Ltd Fourthstone GP LLC Fourthstone QP Opportunity Fund LP Fourthstone Small-Cap Financials Fund LP 13476 Clayton Road St. Louis, Missouri 63131 | 1,277,471 | 5.7 | ||||||

BlackRock, Inc. (2) 55 East 52nd Street New York, New York 10055 | 1,258,538 | 5.7 | ||||||

| (1) | Based on information set forth in a Schedule |

| (2) | Based on information set forth in a Schedule |

6

Stock Ownership Guidelines

In 2016, theThe Company has adopted stock ownership guidelines for its executive officers. The ownership levels under these guidelines are 50,000 shares for the Chief Executive Officer and 25,000 shares for each of the Company’s other executive officers. The guidelines provide that each of the officers should achieve his or her designated level within five years from the adoption date of the guidelines.guidelines, which occurred in December 2016. They further provide that, if the officer’s ownership is not at the designated level, the officer is required to retain all shares of common stock owned, including shares that are received as the result of the exercise of stock options or vesting of restricted stock. The guidelines permit the officer, however, to sell a portion of such shares to cover, as the case may be, the exercise price and income tax liability upon the exercise of stock options or the income tax liability upon the vesting of restricted stock.

Shares of common stock to be included in determining compliance with the designated level include shares held individually and held jointly with spouse, but do not include shares that are held in any other form of beneficial ownership, such as in the capacity as a trustee or custodian.

The Company has an insider trading policy that prohibits directors and executive officers from trading in the Company’s stock on the basis of material non-public information. In addition, the Company does not permit its directors and executive officers to enter into any transaction designed to hedge or offset any change in the market value of the Company’s stock (including short sales, puts, calls, swaps or other derivatives, and all other similar transactions).

The Nominating and Governance Committee of the Company’s Board of Directors oversees, and thus monitors and enforces compliance with, the stock ownership guidelines. The Company has not adopted formal guidelines with respect to stock ownership by its directors.

Delinquent Section 16(a) Beneficial Ownership Reporting ComplianceReports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s executive officers, directors and persons who own more than 10% of its common stock to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission. Executive officers, directors and greater-than-10% shareholders are required by regulation to furnish the Company with copies of all Forms 3, 4 and 5 that they file.

Based on the Company’s review of the copies of those forms, and any amendments that it has received, and written representations from its executive officers and directors, the Company believes that all executive officers, directors and beneficial owners of more than 10% of its common stock complied with all of the filing requirements applicable to them with respect to transactions during the year ended December 31, 20172020 except as set forth as follows. A Form 4 for Richard F. Bozard was inadvertently not filed for each of three purchases ofMessrs. Barber (108 shares), Hardy (116 shares) and Watkins (514 shares) and Ms. Williams (4 shares) was filed late with respect to the Company’s common stock from January 2017 to October 2017. Such purchases, representing 1,975director’s automatic reinvestment, into shares of the Company’s common stock, were made by means of funds transfers, as directed by a prior automatic election request,the cash dividend that the Company paid in Mr. Bozard’s account with the Company’s non-qualified deferred compensation plan administered by the Virginia Bankers Association. January 2020. A Form 4 for William E. HardyMr. Smith (429 shares) was filed late with respect to each of (i) two purchases totaling 1,800his automatic reinvestment, into shares of the Company’s common stock, in March 2017, (ii) the purchase of 1,945 shares of the Company’s common stockcash dividend that the Company paid in August 2017 and (iii) two purchases totaling 655 shares of the Company’s common stock in August 2017.September 2020. A Form 4 for Rex L. Smith, IIIMr. Fain was filed late with respect to the purchase of 1,0003,400 shares of the Company’s common stock in May 2017.November 2020. A Form 4 for Robin Traywick WilliamsMr. Watkins (1,093 shares) was inadvertently not filed for the purchase of 400late with respect to his automatic reinvestment, into shares of the Company’s common stock, of the cash dividend that the Company paid in May 2017.December 2020.

THE BOARD OF DIRECTORS

General

The business and affairs of the Company and its subsidiary Essex Bank (the “Bank”) are managed under the direction of the Board of Directors in accordance with the Virginia Stock Corporation Act and the Company’s Articles of Incorporation and Bylaws, as amended to date. Members of the Board are kept informed of the Company’s business through discussions with the President and Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees.

Director Independence

The Company’s Board of Directors has determined that the following nine10 of its 1011 members are independent as defined by the listing standards of the Nasdaq Stock Market: Gerald F. Barber, Richard F. Bozard,Hugh M. Fain, III, William E. Hardy, P. Emerson Hughes, Jr., Troy A. Peery, Jr.,Ira C. Harris, Gail L. Letts, Eugene S. Putnam, Jr., S. Waite Rawls III, John C. Watkins, Oliver L. Way and Robin Traywick Williams. In reaching this conclusion, the Board of Directors considered whether the Company and its subsidiaries conduct business with companies of which certain members of the Board of Directors or members of their immediate families are or were directors or officers. The Board did not identify anyidentified only one such relationships,relationship, other than banking relationships.

Glenn F. Dozier, who served as a director until his resignation for health reasons on March 13, 2017,The Board specifically considered the relationship between the Bank and Spotts Fain PC, the law firm with which Mr. Fain is affiliated, to determine whether he was also determined to be independent during 2017 until his resignation.

under the listing standards of the Nasdaq Stock Market. See the “Certain Relationships and Related Transactions” section on page 3741 for additional information on certain banking transactionsthis relationship. Under these listing standards, a director who is an executive officer of an organization to which the Company made payments for services in the current or any of the past three fiscal years that exceed five percent of the organization’s consolidated gross revenues for that year, or $200,000, whichever is higher, would not be independent. The Company has not made payments in such amounts to Spotts Fain. In addition to its being below the independence thresholds, the Board further determined that the relationship between the Bank and Spotts Fain would not interfere with membersMr. Fain’s exercise of independent judgment in carrying out his responsibilities as a director.

Richard F. Bozard, who served as a director until his retirement from the Board on May 15, 2020, was also determined to be independent during 2020.

Corporate Governance Guidelines

The Company’s Corporate Governance Guidelines supplement the Company’s Articles of Incorporation and Bylaws, the charters of the Board’s committees and the laws and regulations to which the Company is subject to provide the foundation for the Company’s governance. The guidelines cover, among other matters, the roles of the Board and management, the Board’s critical functions, director responsibilities and qualification and non-delegable actions of the Board. The Company’s Board of Directors reviews these guidelines on an annual basis. A copy of the Corporate Governance Guidelines is available on the “Corporate Overview – Corporate Governance” page of the Company’s internet website at www.cbtrustcorp.com.

Voting Standard for Election of Directors

In March 2021, the Company adopted a majority voting standard for the election of directors. The election of each nominee for director requires the affirmative vote of the holders of a majority of the shares of common stock present or represented by proxy at the Annual Meeting.

In the event that there is a contested election of directors, the standard will be plurality voting, in which the election of each nominee for director requires the affirmative vote of the holders of a plurality of the shares of common stock voted in the election of directors. Thus, those nominees receiving the greatest number of votes cast in that situation will be elected.

The Company has a related “resignation for majority withhold vote” standard for the election of directors, as set forth in its Corporate Governance Guidelines, to cover situations in which a nominee does not receive the required vote for election, but no successor has been elected by shareholders and qualifies or otherwise appointed by the Board of Directors. Any director that receives more “withhold” votes than “for” votes in an election will tender his or her resignation for consideration by the Board’s Nominating and Governance Committee and then the Board of Directors. The Company will publicly disclose the decision with respect to the tendered resignation and the reasons for the decision. A copy of the Corporate Governance Guidelines is available on the “Corporate Overview – Corporate Governance” page of the Company’s internet website at www.cbtrustcorp.com.

Leadership Structure and Risk Oversight

To date, the Company has chosen not to combine the positions of the Chairman of the Board of Directors and the Chief Executive Officer. The Company believes that its leadership structure is appropriate because, by having an outside independent Chairman, there exists an improved degree of independence and balanced oversight of the management of the Board’s functions and its decision-making processes, including those processes relating to the maintenance of effective risk management programs. The Chief Executive Officer makes monthly reports to the Board, often at the suggestion of the Chairman of the Board or other directors, and he explains in detail to the Board the reasons for certain recommendations of the Company’s management.

The Board of Directors is responsible for setting an appropriate culture of compliance within the organization, for establishing clear policies regarding the management of key risks and for ensuring that these policies are adhered to in practice. The risks that are an inherent part of the Company’s business and operations include, but are not limited to, credit risk, market risk, operational risk, liquidity risk, interest rate risk, fiduciary risk, regulatory risk, information security risk (including cyber risk), legal risk and reputational risk. The Board must have an appropriate understanding of the types of risks to which the organization is exposed, and the Board must ensure that the organization’s management is fully capable, qualified and properly motivated to manage the risks arising forfrom the organization’s business activities in a manner that is consistent with the Board’s expectations. Likewise, management is responsible for communicating and reinforcing the compliance culture that the Board has established and for implementing measures to promote the culture throughout the organization.

The Audit Committee of the Board of Directors is responsible for overseeing the Company’s risk management function on behalf of the Board. In carrying out this responsibility, the Audit Committee works closely with the Company’s Chief Risk Officer and Chief Internal Auditor and other members of the Company’s risk management and internal audit teams. The Audit Committee meets regularly with these individuals and receives an overview of findings from various risk management initiatives, including the Company’s enterprise risk management program, internal audits, Sarbanes-Oxley reports regarding internal controls over financial reporting and other regulatory compliance reports. The Company’s Chief Risk Officer, in particular, provides a comprehensive report to the Audit Committee regarding the Company’s key risks. While the Audit Committee has primary responsibility for overseeing risk management, the entire Board of Directors is actively involved in overseeing this function for the Company as, on at least a monthlyquarterly basis, the Board receives a report from the Audit Committee’s chairman and discusses the risks that the Company is facing. These risks are also discussed with members of management.

Other committees of the Board of Directors consider the risks within their areas of responsibility. For example, the Compensation Committee considers the risks that may be inherent in the Company’s compensation programs for both executive officers and other employees. For additional information regarding the Compensation Committee, see the “Executive Compensation” section beginning on page 2023 of this proxy statement.

The Board of Directors maintains an effective risk management program to address oversight, control and supervision of the Bank’s management, major operations and activities. With a focus on implementing cost-effective improvements to its risk management systems and to the other areas where improvements are needed, the Board of Directors and the management team are committed to continuous improvement and strengthening of the Company’s governance, risk management and control practices. As noted above, the Board of Directors and its committees regularly review and discuss risk management issues with management at each of their meetings.

Code of Ethics

The Company’s Board of DirectorsCompany has approved a Code of Business Conduct and Ethics for directors, officers and all employees of the Company and its subsidiaries, including the Company’s principal executive officer, principal financial officer and principal accounting officer. The Company’s Board of Directors reviews the Code on an annual basis. A copy of the Code of Business Conduct and Ethics is available on the “Corporate Overview – Corporate Governance” page of the Company’s Internet web siteinternet website atwww.cbtrustcorp.com.www.cbtrustcorp.com.

Board and Committee Meeting Attendance

There were 1314 meetings of the Board of Directors in 2017. With the exception of Mr. Dozier, who resigned from the Board in March 2017, each2020. Each director attended at least 75% of the aggregate number of meetings of the Board of Directors and meetings of committees of which the director was a member in 2017.2020.

Independent Directors Meetings

Non-employee directors meet periodically outside ofin executive sessions before and after regularly scheduled Board meetings.

Committees of the Board

The Board of Directors has standing audit, compensationsix committees, which are listed, with their members, and nominating committees.described below.

| Audit Committee | Nominating and Governance Committee | |||

| Barber, Chair | Putnam, Jr., Chair | Hardy, Chair | ||

| Hardy | Fain | Fain | ||

| Harris | Letts | Letts | ||

| Rawls | Watkins | Williams | ||

| Williams |

| Strategic Planning Committee | ALCO (Asset/Liability Management Committee) | Credit Committee | ||

| Watkins, Chair | Rawls, Chair | Williams, Chair | ||

| Barber | Barber | Hardy | ||

| Fain | Putnam | Rawls | ||

| Putnam | Way | Watkins | ||

| Smith | Way |

Audit Committee

The Audit Committee assists the Board in the fulfillment of its oversight responsibilities with respect to the completeness and accuracy of the Company’s financial reporting and the adequacy and effectiveness of its financial and operating controls. The primary purpose of the Audit Committee is to provide independent and objective oversight with respect to the integrity of the Company’s financial statements, the independent auditor’s qualifications and independence, the performance of the Company’s internal audit function and independent auditors, the effectiveness of the Company’s internal control over financial reporting and compliance by the Company with legal and regulatory requirements. The Audit Committee also provides oversight of the Company’s risk management programs and activities and reviews the effectiveness of the Company’s process for managing and assessing risk. A copy of the Audit Committee’s charter is available on the “Corporate Overview – Corporate Governance” page of the Company’s Internet web siteinternet website atwww.cbtrustcorp.com.www.cbtrustcorp.com.

The current members of the Audit Committee are Gerald F. Barber (Chair), William E. Hardy, Troy A. Peery, Jr., S. Waite Rawls III and Robin Traywick Williams. The Company’s Board of Directors has determined that each of Messrs. Barber Hardy and PeeryHardy qualifies as an audit committee financial expert, as defined by the rules and regulations of the Securities and Exchange Commission, and that each member of the Audit Committee is independent, as independence for audit committee members is defined by the Nasdaq Stock Market’s listing standards.

The Audit Committee met 11eight times in 2017.2020. For additional information regarding the Audit Committee, see the “Report of the Audit Committee” section beginning on page 4144 of this proxy statement.

Compensation Committee

The Compensation Committee assists the Board in the fulfillment of its oversight responsibilities with respect to the Company’s executive compensation. The primary purpose of the Compensation Committee is to ensure that the compensation and benefits for senior management and the Board of Directors are fair and appropriate, are aligned with the interests of the Company’s shareholders and do not pose a risk to the financial health of the Company or its affiliates. A copy of the Compensation Committee’s charter is available on the “Corporate Overview – Corporate Governance” page of the Company’s Internet web siteinternet website atwww.cbtrustcorp.com.

The current members of the Compensation Committee are Eugene S. Putnam, Jr. (Chair), Troy A. Peery, Jr. and John C. Watkins. The Company’s Board of Directors has determined that each member of the Compensation Committee is independent, as defined by the Nasdaq Stock Market’s listing standards. The Compensation Committee met threefour times in 2017.2020.

The Company’s compensation program consists generally of salary, annual cash bonus and incentives, equity-based long-term compensation and pre- and post-retirement benefits. The Compensation Committee is responsible for the review and approval of the Company’s compensation plans, compensation for senior management, salary and bonus ranges for other employees and allany employment, severance, and change in control and retirement agreements. The Compensation Committee also reviews and approves compensation for the directors of the Company and its banking subsidiary. The Compensation Committee recommends that its determinations be ratified by the independent members of the Company’s Board of Directors. The Compensation Committee has not delegated any of its authority to other persons.

In making its determinations with respect to compensation, the Compensation Committee has relied on recommendations from the Company’s President and Chief Executive Officer with respect to the salaries of the Company’s senior management and bonus levels for all employees. The Compensation Committee and the President and Chief Executive Officer work together to finalize these salary and bonus decisions. TheIn addition, the Compensation Committee determinesreviews, discusses and recommends to the full Board of Directors for approval the compensation of the President and Chief Executive Officer, and theOfficer. The Board of Directors, after similar review and discussion, either accepts and approves this determination.the Compensation Committee’s recommendation or approves the President and Chief Executive Officer’s compensation after making adjustments to it.

During the fiscal year ended December 31, 2017,2020, the Committee engaged Matthews Young – Management ConsultingPearl Meyer & Partners, LLC (“Pearl Meyer”) to provide compensation consulting services to the Committee. The consultant assisted the Committee in reviewing the competitive marketplace compensation levels for the Company’s executive officers. The consultant worked directly for the Committee and met with Committee members without management present.

In retaining the consultant as the Committee’s advisor, the Committee reviewed the factors necessary for evaluating the consultant’s independence status. These factors were as follows:

| · | The Committee reviewed the services provided to the Company and determined that consulting assistance was provided to the Committee or on behalf of the Committee with its approval and review. |

| · | The Committee reviewed and determined that the consultant’s total fees for services to the Company were not a material percentage of the consultant’s total consulting revenues. |

| · | The Committee reviewed information from the consultant stating that its consultants have no business or personal relationship with any member of the Committee, have no business or personal relationship with any member of executive management and own no common stock in the Company. |

For additional information regarding the Compensation Committee, see the “Executive Compensation” section beginning on page 2023 of this proxy statement.

Nominating and Governance Committee

The Nominating and Governance Committee (the “Nominating Committee”) assists the Board in the fulfillment of its oversight responsibilities with respect to the Company’s corporate governance. At each meeting, the Nominating Committee reviews and discusses corporate governance benchmarks, including benchmarks relating to board composition and diversity, elections and board refreshment, board committees, board meetings and performance and governance policies. The Nominating Committee recognizes that governance standards are ever-evolving, and it analyses these standards with an appropriate balance of an emphasis on long-term shareholder value, overall governance principles and standards comparative with the Company’s peers in the community banking industry.

The Nominating Committee is also responsible primarily for making recommendations to the Board of Directors regarding the membership of the Board, including recommending to the Board the slate of director nominees for election at each annual meeting of shareholders, considering, recommending and recruiting candidates to fill any vacancies or new positions on the Board, including candidates that may be recommended by shareholders, establishing criteria for selecting new directors and reviewing the backgrounds and qualifications of possible candidates for director positions. A copy of the Nominating Committee’s charter is available on the “Corporate Overview – Corporate Governance” page of the Company’s Internet web siteinternet website atwww.cbtrustcorp.com.

The current members of the Nominating Committee are P. Emerson Hughes, Jr. (Chair), Richard F. Bozard, William E. Hardy and Robin Traywick Williams. The Company’s Board of Directors has determined that each member of the Nominating Committee is independent, as defined by the Nasdaq Stock Market’s listing standards. The Nominating Committee met four times in 2017.2020.

In identifying potential nominees for service as a director, the Nominating Committee takes into account such factors as it deems appropriate, including the current composition of the Board, to ensure diversity among its members. Diversity includes the range of talents, experiences and skills that would best complement those that are already represented on the Board, the balance of management and independent directors and the need for specialized expertise. Diversity also includes education, race, gender and the geographic areas where the individual has resided, worked or served. The Nominating Committee considers candidates for Board membership suggested by Board members and by management, and it will also consider candidates suggested informally by a shareholder of the Company.

Mr. Harris, who was appointed to the Board since the 2020 annual meeting of shareholders and is being presented for election as a director for the first time at the Annual Meeting, was presented to the Nominating Committee by management.

The Nominating Committee considers, at a minimum, the following factors in recommending to the Board of Directors potential new directors, or the continued service of existing directors:

| · | Leadership and business executive management |

| · | Financial and regulatory experience |

| · | Integrity, honesty and reputation |

| · | Dedication to the Company and its shareholders |

| · | Independence |

| · | Any other factors that the Nominating Committee deems relevant, including age, size of the Board of Directors and regulatory approval considerations |

The Nominating Committee may weight the foregoing criteria differently in different situations, depending on the composition of the Board of Directors at the time. In addition, prior to nominating an existing director for re-election to the Board of Directors, the Nominating Committee will consider and review an existing director’s Board and committee attendance and performance, independence, length of board service, and experience, skills and contributions that the existing director brings to the Board.

13

Shareholders entitled to vote for the election of directors may submit candidates for formal consideration by the Nominating Committee in connection with an annual meeting if the Company receives timely written notice, in proper form, for each such recommended director nominee. If the notice is not timely and in proper form, the nominee will not be considered by the Company. To be timely for the 20192021 annual meeting, the notice must be received within the time frame set forth in the “Shareholder Proposals” section on page 4245 of this proxy statement. To be in proper form, the notice must include each nominee’s written consent to be named as a nominee and to serve, if elected, and information about the shareholder making the nomination and the person nominated for election. These requirements are more fully described in Section 3.4 of the Company’s Bylaws, a copy of which will be provided, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is Community Bankers Trust Corporation, 9954 Mayland Drive, Suite 2100, Richmond, Virginia 23233.

Strategic Planning Committee

The Strategic Planning Committee, which the Board created in 2014, assists the Board in the fulfillment of its oversight responsibilities with respect to the analysis, discussion and review of key strategic decisions at times outside of the Board’s annual strategic retreat. The Committee assists management in ensuring that the Company has a viable growth plan in place for new markets, new branches, business lines and whole bank merger and acquisition activity that considers the resources and capital of the Company, the current company-wide strategic plan and the overall long-term return to shareholders. Among other responsibilities, the Committee reviews the Company’s growth plan on a continual basis, and provides recommendations to the Board for modifications as deemed necessary, and reviews any proposed new business line acquisitions or start-ups.

The Strategic Planning Committee meets as needed and met one time in 2020.

ALCO (Asset/Liability Management Committee)

The ALCO assists the Board in the fulfillment of its oversight responsibilities with respect to defining the Company’s balance sheet and other financial strategies to preserve capital and maximize earnings and the setting of interest rates on both sides of the balance sheet to meet these strategies. The Committee establishes and monitors liquidity and interest rate risk targets in addition to the strategies to meet these targets. It also ensures that sufficient liquidity is available for unanticipated contingencies.

The ALCO Committee has met generally on a monthly basis over the past year and met nine times in 2020.

Credit Committee

The Credit Committee, which the Board created in 2010 with its current responsibilities, assists the Board in the fulfillment of its oversight responsibilities with respect to senior management’s identification and management of the Company’s credit processes and risk management practices on an enterprise-wide basis and the Company’s responses to trends affecting those matters. It also assists the Board in oversight of management’s actions to ensure the accuracy and credibility of the Company’s risk grading system and procedures and the adequacy of the allowance for credit losses and the Company’s credit-related policies. The Committee reviews and approves all credit decisions with respect to borrower relationships that are larger than $8.0 million.

The Credit Committee meets on at least a monthly basis and met 16 times in 2020.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is a current or former officer or employee of the Company or any of its subsidiaries. In addition, there are no compensation committee interlocks with other entities with respect to any such member.

Annual Meeting Attendance

Meetings of the Board of Directors and its committees are held in conjunction with the annual meeting of shareholders, and the Company expects all directors and nominees to attend each annual meeting of shareholders. NineAll of the Board’s 10then current directors attended the 20172020 annual meeting.

Communications with Directors

Any director may be contacted by writing to him or her in care of Community Bankers Trust Corporation, 9954 Mayland Drive, Suite 2100, Richmond, Virginia 23233. Communications to the non-management directors as a group may be sent to the same address, c/o the Secretary of the Company. The Company promptly forwards, without screening, all such correspondence to the indicated directors.

Director Compensation

The Board of Directors approves director compensation on an annual basis following a review of the recommendation of the Compensation Committee. The independent consultant that the Compensation Committee retains reviews the Company’s director compensation and benchmarks it against the director compensation of the Company’s peer banks.

TheFor the period from June 2020 to May 2021, the Company currently compensates its non-employee directors as follows:

| · | Quarterly board retainer of |

| · | Additional quarterly retainer for the Chairman of the Board of |

| · | Additional retainer for each chairman of a Board committee of $1,250 in cash per quarter |

| · | Board meeting fees for the Chairman of the Board of |

| · | Board meeting fees for other non-employee directors of |

| · | Committee meeting fees of |

The total compensation of the Company’s non-employee directors for the year ended December 31, 20172020 is shown in the following table.

| Name | Fees Earned or Paid in Cash ($)(4) | Stock Awards ($)(5) | Nonqualified Deferred Compensation Earnings ($)(6) | Total ($) | ||||||||||||

| Gerald F. Barber | 25,364 | 15,982 | — | 41,346 | ||||||||||||

| Richard F. Bozard | 22,300 | 15,982 | — | 38,282 | ||||||||||||

| Glenn J. Dozier (1) | 986 | 4,000 | — | 4,986 | ||||||||||||

| William E. Hardy (2) | 16,650 | 15,286 | — | 31,936 | ||||||||||||

| P. Emerson Hughes, Jr. | 21,350 | 15,982 | 2,872 | 40,204 | ||||||||||||

| Troy A. Peery, Jr. | 19,100 | 15,982 | — | 35,082 | ||||||||||||

| Eugene S. Putnam, Jr. | 22,475 | 15,982 | — | 38,457 | ||||||||||||

| S. Waite Rawls III | 25,625 | 15,982 | — | 41,607 | ||||||||||||

| Rex L. Smith, III (3) | — | — | — | — | ||||||||||||

| John C. Watkins | 24,575 | 27,976 | — | 52,551 | ||||||||||||

| Robin Traywick Williams | 29,725 | 15,982 | — | 45,707 | ||||||||||||

| Name | Fees Earned or ($)(4) | Stock Awards ($)(5) | Total ($) | |||||||||

| Barber | 28,750 | 19,987 | 48,737 | |||||||||

| Bozard (1) | 9,868 | 4,992 | 14,860 | |||||||||

| Fain | 20,000 | 19,987 | 39,987 | |||||||||

| Hardy | 32,250 | 19,987 | 52,237 | |||||||||

| Harris (2) | 3,000 | 7,358 | 10,358 | |||||||||

| Letts | 18,000 | 19,987 | 37,987 | |||||||||

| Putnam | 26,250 | 19,987 | 46,237 | |||||||||

| Rawls | 32,632 | 19,987 | 52,619 | |||||||||

| Smith (3) | -- | -- | -- | |||||||||

| Watkins | 29,950 | 35,974 | 65,924 | |||||||||

| Way | 26,000 | 19,987 | 45,987 | |||||||||

| Williams | 32,250 | 19,987 | 52,237 | |||||||||

| (1) | Mr. |

| (2) | Mr. |

| (3) | Mr. Smith, as an employee of the Company, does not receive any compensation for his service as a director. |

| (4) | Amounts represent Board meeting fees, committee meeting fees, and retainers for committee chairmen earned during the year. |

| (5) | Amounts represent retainers. Shares of common stock were issued to the directors following the date of the award. The date of each stock award, the number of shares in the award and the grant date fair value of the award are shown in the following table. |

| Name | Date of Award | Number of Shares | Grant Date Fair Value Per Share ($) | |||||||||

| Each of | March 1, 2017 | 500 | 8.00 | |||||||||

| Gerald F. Barber | June 1, 2017 | 493 | 8.10 | |||||||||

| Richard F. Bozard | September 1, 2017 | 473 | 8.45 | |||||||||

| P. Emerson Hughes, Jr. | December 1, 2017 | 481 | 8.30 | |||||||||

| Troy A. Peery, Jr. | ||||||||||||

| Eugene S. Putnam, Jr. | ||||||||||||

| S. Waite Rawls III | ||||||||||||

| Robin Traywick Williams | ||||||||||||

| Glenn F. Dozier | March 1, 2017 | 500 | 8.00 | |||||||||

| William E. Hardy | March 17, 2017 | 391 | 8.45 | |||||||||

| June 1, 2017 | 493 | 8.10 | ||||||||||

| September 1, 2017 | 473 | 8.45 | ||||||||||

| December 1, 2017 | 481 | 8.30 | ||||||||||

| John C. Watkins | March 1, 2017 | 875 | 8.00 | |||||||||

| June 1, 2017 | 863 | 8.10 | ||||||||||

| September 1, 2017 | 828 | 8.45 | ||||||||||

| December 1, 2017 | 842 | 8.30 | ||||||||||

| Name |

Date of Award |

Number of Shares | Grant Date Fair Value Per Share ($) | |||||||||

Each of: | March 1, 2020 | 611 | 8.17 | |||||||||

| Barber | June 1, 2020 | 912 | 5.48 | |||||||||

| Fain | September 1, 2020 | 984 | 5.08 | |||||||||

| Hardy | December 1, 2020 | 775 | 6.45 | |||||||||

| Letts | ||||||||||||

| Putnam | ||||||||||||

| Rawls | ||||||||||||

| Way | ||||||||||||

| Williams | ||||||||||||

| Harris | October 16, 2020 | 459 | 5.14 | |||||||||

| December 1, 2020 | 775 | 6.45 | ||||||||||

| Bozard | March 1, 2020 | 611 | 8.17 | |||||||||

| Watkins | March 1, 2020 | 1,100 | 8.17 | |||||||||

| June 1, 2020 | 1,641 | 5.48 | ||||||||||

| September 1, 2020 | 1,771 | 5.08 | ||||||||||

| December 1, 2020 | 1,395 | 6.45 | ||||||||||

16

ELECTION OF DIRECTORS

General

The Company’s Board of Directors currently consists of 1011 directors and is divided into three classes with staggered terms. The directors in Class I serve for a term that expires at the Annual Meeting, the directors in Class II serve for a term that expires at the 20192022 annual meeting of shareholders and the directors in Class III serve for a term that expires at the 20202023 annual meeting of shareholders.

The Board, upon the recommendation of the Nominating Committee, has nominated Hugh M. Fain, III, Ira C. Harris, Rex L. Smith, III John C. Watkins and Robin TraywickT. Williams for election to the Board at the Annual Meeting. All of the nominees presently serve as directors – the terms of Messrs. Fain and their termsSmith and Ms. Williams will expire at the Annual Meeting.Meeting, and Mr. Harris, as a director appointed since the 2020 annual meeting of shareholders, is being presented to the shareholders for the first time. The Company is asking shareholders to elect Mr. Harris for a two-year term that expires at the three nominees2023 annual meeting of shareholders and Messrs. Fain and Smith and Ms. Williams for a three-year term that expires at the 20212024 annual meeting of shareholders.

Each nominee, if elected, will serve for the nominee’s respective term and until his or her successor is elected and qualifies or until there is a decrease in the number of directors.

The Board of Directors recommends that the shareholders voteFOR the election of Messrs. SmithFain, Harris and WatkinsSmith and Ms. Williams. If you sign and return your proxy card in the enclosed envelope or execute a proxy by telephone or through the Internet,internet, the persons named in the enclosed proxy card will vote to elect these three nominees unless you indicate otherwise. Your proxy for the Annual Meeting cannot be voted for more than three nominees.

Each of the Company’s nominees has indicated the willingness to serve if elected. If any nominee of the Company is unable or unwilling to serve as a director at the time of the Annual Meeting, then shares represented by properly executed proxies will be voted at the discretion of the persons named in those proxies for such other person as the Board may designate. The Company does not presently expect that any of the nominees will be unavailable.

The election of each nominee for director requires the affirmative vote of the holders of a pluralitymajority of the shares of common stock voted inpresent or represented by proxy at the Annual Meeting.

The Company has a related “resignation for majority withhold vote” standard for the election of directors. Thus, those nominees receivingdirectors, as set forth in its Corporate Governance Guidelines, to cover situations in which a nominee does not receive the greatest numberrequired vote for election, but no successor has been elected by shareholders and qualifies or otherwise appointed by the Board of Directors. Any director that receives more “withhold” votes castthan “for” votes in an election will be elected.tender his or her resignation for consideration by the Board’s Nominating and Governance Committee and then the Board of Directors. The Company will publicly disclose the decision with respect to the tendered resignation and the reasons for the decision. A copy of the Corporate Governance Guidelines is available on the “Corporate Overview – Corporate Governance” page of the Company’s internet website at www.cbtrustcorp.com.

The term of P. Emerson Hughes, Jr.John C. Watkins as a Class I director expires at the Annual Meeting, and Mr. HughesWatkins cannot stand for re-election under the age restrictions set forth in the Company’s Corporate Governance Guidelines. The Guidelines provide that a director not stand for re-election if the director is 73 or older at the end of his or her expiring term. The Company expresses its sincere gratitude to Mr. HughesWatkins for his service as a director over the past 23 years. He has been a director of BOEthe Company since 2008 and has served as Chairman of the Board since 2011, and he had previously served as a director of TransCommunity Financial Corporation (“TransCommunity Financial”), which the Company acquired in 2008, and its successorspredecessor, Bank of Powhatan, N.A., since 2004.1998.

The following information sets forth the business experience for at least the past five years and other information for all nominees and all other directors whose terms will continue after the Annual Meeting. Such information includes each director’s service on the boardsboard of TransCommunity Financial, Corporation, which the Company acquired in 2008 (“TransCommunity Financial”), and BOE Financial, as the case may be. References to a director’s service on the board of BOE Financial include service on the board of its predecessor, Essex Bank (which became a wholly owned subsidiary of the BOE Financial in 2000) (the “Bank”).2008.

Nominees for Election to a Three-Year Term (Class I Directors)

Hugh M. Fain, III, 63, has been a director of the Company since 2018. Mr. Fain is President and a director of Spotts Fain PC, a law firm in Richmond, Virginia, where he has been a lawyer since 1992. He has over 35 years of experience as a civil trial attorney in a broad range of commercial and business matters. Mr. Fain’s representative clients include both public and private companies, as well as individual entrepreneurs, many of whom rely on him for general business counsel.

In addition to his strategic planning and management skills, Mr. Fain has been active with numerous organizations and provides the Board with expertise in corporate governance and fiduciary duties. He also has significant community ties to the Bank’s central Virginia market areas that support its business development initiatives.

Rex L. Smith, III, 60,63, has been a director of the Company since 2011. Mr. Smith has been President and Chief Executive Officer of the Company and the Bank since 2011. He served as the Bank’s Executive Vice President and Chief Banking Officer from 2010 to 2011, and he held the responsibilities of President and Chief Executive Officer of the Company and the Bank, including serving as Executive Vice President of the Company, for eight months in 2010 and 2011. From 2009 to 2010, he was the Bank’s Executive Vice President and Chief Administrative Officer. From 2007 to 2009, he was the Central Virginia President for Gateway Bank and& Trust and, from 2000 to 2007, he was President and Chief Executive Officer of The Bank of Richmond.

Mr. Smith has over 3540 years of experience in the banking industry and a unique perspective from the management experiences that he has had with different banks. He is also intimately aware of the particular opportunities and challenges facing the Company and the Bank, as he has been a member of executive management for nine12 years.

John C. Watkins, 71, has been a director of the Company since 2008 and has served as Chairman of the Board since 2011. He had previously served as a director of TransCommunity Financial and its predecessor, Bank of Powhatan, N.A., since 1998. Senator Watkins was President of Watkins Nurseries, Inc., a landscape design firm and wholesale plant material grower based in Midlothian, Virginia, from 1998 to 2008, and he currently serves as the Chairman of its board of directors. He has also been Manager and Development Director for Watkins Land, LLC, a real estate company based in Midlothian, Virginia, since 1999. He was a member of the Virginia House of Delegates from 1982 to 1998, a member of the Senate of Virginia from 1998 to 2016 and a member of the Powhatan County Economic Development Authority since 2016.

Senator Watkins brings long-term corporate management experience as a small business owner and entrepreneur, through his ownership and operation of successful businesses in the Company’s market areas. He also brings substantial government and public policy expertise and leadership knowledge to the Company due to his long service in the Virginia state government. He has significant community ties to the Bank’s central Virginia market areas.

Robin Traywick Williams, 67,70, has been a director of the Company since 2008. She had previously served as a director of TransCommunity Financial since 2002. Mrs. Williams is a writer and, from 2009 to 2011, she served as president of the Thoroughbred Retirement Foundation. From 1998 to 2003, she served as Chairman of the Virginia Racing Commission in Richmond, Virginia.

Mrs. Williams brings regulatory and governance leadership to the Board through her experience with Virginia government and regulatory agencies and community organizations. She also has significant community ties to the Bank’s central Virginia market areas.

Nominee for Election to a Two-Year Term (Class III Director)

Ira C. Harris, 61, has been a director of the Company since October 2020. Dr. Harris is a Professor and the Director of the Master of Science Program at the McIntire School of Commerce at the University of Virginia and has been a member of the school’s faculty since 2003. Before joining the McIntire School, he taught at the University of Notre Dame and Texas A&M University. Dr. Harris has owned and operated Store-Tel Storage, his family’s self-storage business in Tappahannock, Virginia, since 2003. He is a certified public accountant.

Dr. Harris’s expertise focuses on business management, corporate governance and mergers and acquisitions. He also has direct personal experience with the community banking industry and the analysis and approach of a board of directors to major strategic decisions. Dr. Harris previously served on the Board of Directors of Eastern Virginia Bankshares, Inc. from 2004 until it was acquired by Southern National Bancorp of Virginia, Inc. (now known as Primis Financial Corp.) in 2017.

Directors Whose Terms Do Not Expire This Year (Class II and Class III Directors)

Gerald F. Barber, 66,69, has been a director of the Company since 2014. Mr. Barber is a finance professional with over 40 years of experience in accounting, auditing and consulting. He has worked with organizations of all sizes from start-up businesses to multi-national corporations and has delivered services to organizations in numerous industries, including banking, financial services, consumer/industrial products, retail and technology. He was a Transaction Services Partner with PricewaterhouseCoopers LLP (“PwC”) from 2001 to 2012 and led the U.S. Latin America Transaction Services Practice in Washington, D.C. and Miami, Florida from 2004 to 2012. Since his retirement from PwC in 2012, Mr. Barber has continued advising both middle market and multi-national corporations. He served as an adjunct professor at the University of Virginia’s McIntire School of Commerce during 2012 and 2013. He has been in the audit and accounting field since 1975.

Mr. Barber brings extensive experience in the areas of accounting and auditing, merger and acquisition transactions, financial services and management. He is a Certified Public Accountant.

Richard F. BozardWilliam E. Hardy, 71,65, has been a director of the Company since 2008. He had previously served as a director of TransCommunity Financial since 2006. Mr. Bozard was Vice President and Treasurer of Owens & Minor, Inc., a medical and surgical supplies distributor based in Mechanicsville, Virginia, from 1991 until his retirement in 2009. He had also been Senior Vice President and Treasurer of Owens & Minor Medical, Inc., a subsidiary of Owens & Minor, Inc., from 2004 until his retirement.

Mr. Bozard brings broad experience in the areas of management and oversight of public companies. He also has significant experience in asset and liability management, finance, strategic planning and mergers and acquisitions, which provides both the Board and management with a substantial resource, and thus he serves as Chair of the Board’s Asset and Liability Committee.

William E. Hardy, 62, has been a director of the Company since March 2017. Mr. Hardy is a certified public accountant with over 35 years of accounting and auditing experience in the central Virginia market. He is a partner and the Chief Executive Officer of Harris, Hardy & Johnstone, P.C., an accounting firm in Richmond, Virginia, that he founded in 1987. Mr. Hardy’s expertise covers numerous industries, including hotels, real estate, manufacturing, construction contractors and wholesale and retail operations. He has been in the audit and accounting field since 1983.

In addition to his accounting and auditing background, Mr. Hardy provides the Board with financial insight into many diverse industries. He also has significant community ties to the Bank’s central Virginia market areas.

Troy A. Peery, Jr.Gail L. Letts, 71,68, has been a director of the Company since 2008 and served as Vice Chairman of the Board from 2008 to 2011. He had previously served as a director of TransCommunity Financial since 2002. Mr. Peery2019. Ms. Letts has been President of Peery Enterprises,Letts Consult, LLC, a real estate development company basedbusiness consulting firm in Manakin-Sabot,Richmond, Virginia, since 1998.2019. She also has over 35 years of experience as an executive in the banking industry, with a focus on strategic planning, financial and sales management, organizational transformation and revenue growth. Ms. Letts was Virginia Market President of Capital Bank, a Division of First Tennessee Bank, in Richmond, Virginia from 2015 to 2019. She was Richmond Region President and Head of Commercial Lending/Business Banking for C&F Bank from 2013 to 2015. From 2007 to 2013, Ms. Letts was President and Chief Executive Officer of the Central Virginia Region of SunTrust Bank, and she has 30 years of experience with SunTrust Bank and its predecessors.

Mr. Peery bringsMs. Letts has extensive executive experience overseeing teams providing retail banking, commercial banking, business banking and wealth solutions to customers. She also led these teams, and assisted the banks for which she worked, through organizational change, cultural transformation and acquisition/growth expansion. Ms. Letts has significant operational, financial managementprofessional and governance experience, including his prior service in executive management and as a director for Heilig-Meyers Company, Open Plan Systems, Inc. and S & K Famous Brands, Inc.,community ties throughout all of which were public companies. He also has significant community ties to the Bank’s central Virginia market areas.markets.

19

Eugene S. Putnam, Jr., 58,61, has been a director of the Company since 2005 and served as its Chairman of the Board from 2005 to 2008. Mr. Putnam has been Chief Financial Officer for EVO Transportation & Energy Services, Inc., a nationwide transportation operator for the United States Postal Service and various freight shippers, since 2019. He was President and Chief Financial Officer for Universal Technical Institute, Inc., a post-secondary education provider based in Scottsdale, Arizona, from 2011 to November 2016. HeMr. Putnam served as Executive Vice President and Chief Financial Officer for Universal Technical Institute, Inc. from 2008 to 2011, and he served as its interim Chief Financial Officer from January 2008 to July 2008.2011.

Mr. Putnam brings high level financial expertise as chief financial officer of publicly traded companies and experience in risk management and strategic planning. He also has banking expertise in corporate finance, capital planning and balance sheet management. His background helps him play critical roles on the Board’s committees.

S. Waite Rawls III, 69,72, has been a director of the Company since 2011. Mr. Rawls has beenwas President of the American Civil War Museum Foundation in Richmond, Virginia, since 2016.from 2016 until his retirement in 2019. He was Co-Chief Executive Officer of the American Civil War Museum in Richmond, Virginia, from 2013 to 2016. He was President of the Museum of the Confederacy in Richmond, Virginia, from 2004 to 2013.

Mr. Rawls has numerous years of leadership positions in, among others, the technology, financial management and capital market fields, all of which underscore the insight that he has as a director. Mr. Rawls also has 18 years of working experience in the banking industry, serving as Vice Chairman of Continental Bank in Chicago, Illinois for four years and as Managing Director of Chemical Bank in New York, New York for 14 years. While the banking industry has changed, Mr. Rawls remains very familiar with the issues facing banks and the regulatory environment in which they operate.

Oliver L. Way, 68, has been a director of the Company since 2018. From 2005 until his retirement in 2018, Mr. Way was Executive Vice President and Virginia Markets Regional President of Fulton Bank, N.A., the banking subsidiary of Fulton Financial Corporation based in Lancaster, Pennsylvania. At Fulton Bank, he oversaw banking operations, planning and strategic initiatives in its Virginia markets. Mr. Way has over 40 years’ experience in the financial services industry, including 23 years with Wachovia Bank and its predecessor, Central Fidelity Bank.

Mr. Way brings many years of experience and expertise in leadership, business development, risk management and credit analysis. He also has significant community and financial industry ties to the Bank’s central Virginia market areas.

20